Weekend Preview: ’28 Years Later: The Bone Temple’ and the Sequel Marketing Test

January 15, 2026

The sequel to 28 Years Later, releasing only seven months after its June 2025 release date, is the third consecutive horror film of the new year and one of the most highly anticipated horror follow-ups. After the first film’s moderate performance, Sony is eyeing whether the critically lauded sequel will match, overtake, or drop some audience from its predecessor. Sequels typically perform better than their previous installments at the box office. But what aspects of a sequel actually signal a stronger performance versus a weaker one?

Hollywood has bombarded audiences with sequels in recent years. Some outperformed the originals overall while some fell short. Others enjoyed bigger opening weekends than prior installments but sputtered domestically after that, while others opened smaller but proved far leggier. The key to accurate expectations is reading the audience signals in real time.

In many sequel instances, the industry locks onto assumptions based on the hype, awareness, and performance of prior films. Yes, past franchise results play a role in projecting future outcomes. But inaccuracies arise when studios don’t account for growing sentiments toward the new films, namely Theatrical Intent. Does that mean that growing awareness is a useless endeavor? It might depend on whose awareness.

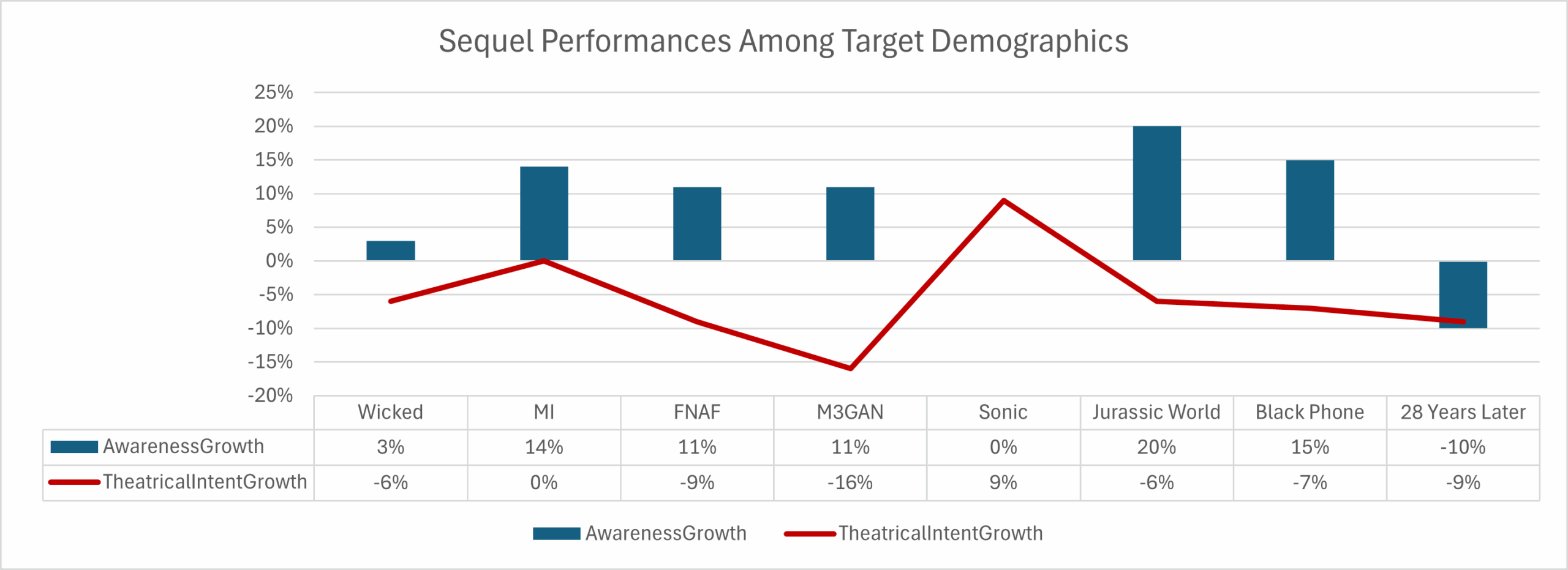

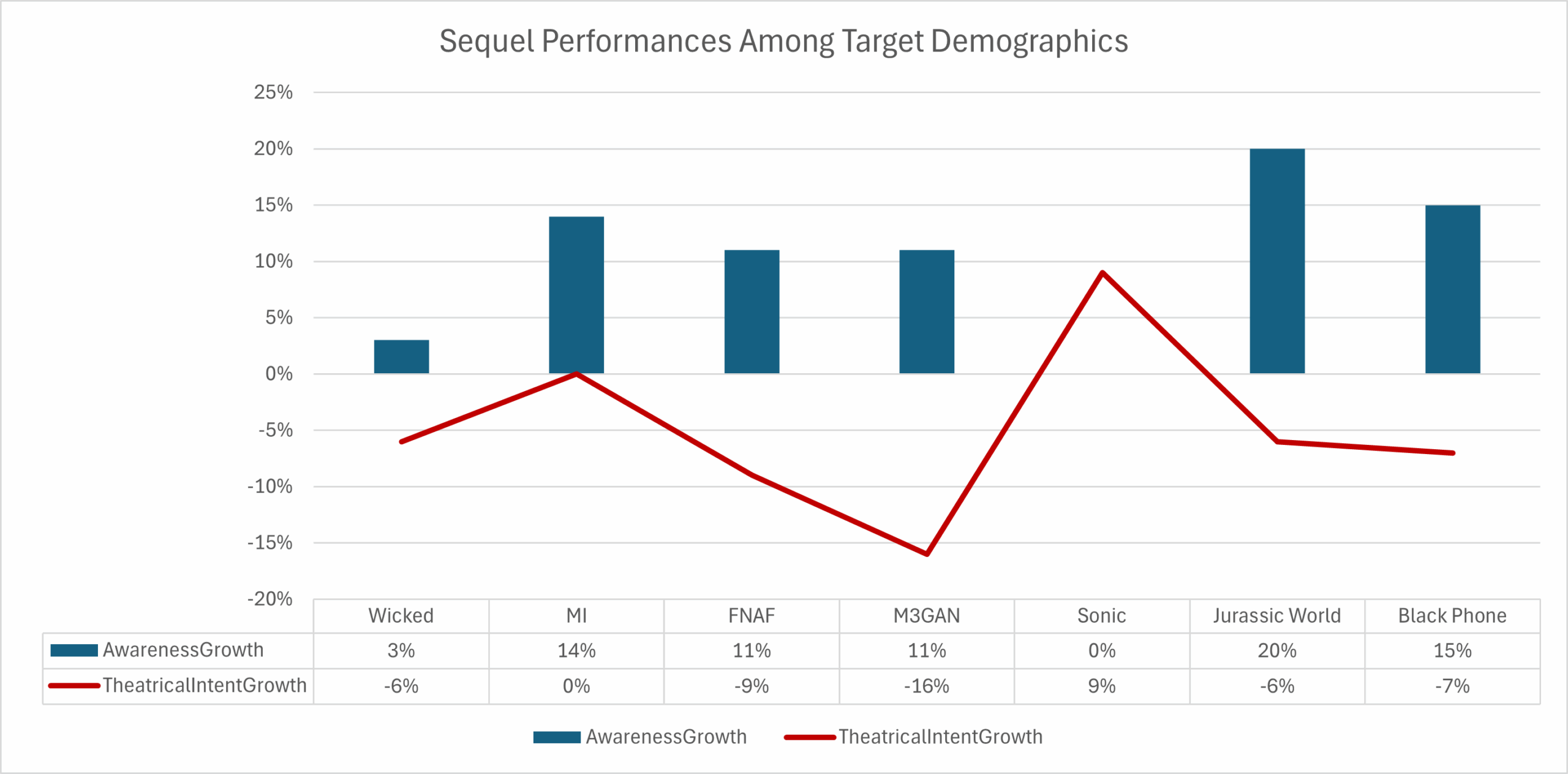

Analyzing seven different sequel performances across different scales and genres, certain patterns emerge:

- Awareness cannot overcome an intent gap

A number of films showed decreases in theatrical intent among general audiences, but the concern always lies with the target demographics. Horror sequels Five Nights at Freddy’s 2 and M3GAN 2.0 followed breakout original hits, and this success helped generate significant gains in awareness. Both sequels saw 11% jumps over their first films among the under-35 demographic. However, M3GAN 2.0’s awareness gain faced a sharp decline of 16% in theatrical intent among that same group. This new intent rate was down below majority levels at 45% and closer to more moderate performing horror films rather than a horror sequel. Although Five Nights at Freddy’s 2 experienced a similar decline of 11% in theatrical intent among under-35s, a separate pattern comes into play…

- Awareness CAN soften the blow.

Despite a sharp decline, theatrical intent for Five Nights at Freddy’s 2 for the under-35 demographic still remained at a strong 50% tied to wide-spread awareness that went above 66%. The dedicated awareness pushing the targeted age bracket coupled with the strong remaining theatrical base resulted in a $64 million opening that was 20% behind the first film’s, but still highly successful. The total domestic gross still nearly matched the previous film.

Even films with smaller gaps were still able to over-perform thanks to the additional awareness among the target groups. Black Phone 2, which dropped only 7% in theatrical intent among the under-35 audience compared to The Black Phone, grew 15% in awareness compared to the previous film. Rather than an opening weekend drop, the film wound up enjoying a slight over-performance. Jurassic World Rebirth saw a 6% decline in theatrical intent among the general audience. But its awareness grew a whopping 20%leading to an over-performance for opening weekend within 10% of the previous film’s debut. All of this raises an essential question for Hollywood business: What does it look like when a movie can maintain its theatrical intent among the core target audience from film to film?

- Consistency in Intent + Awareness = Success

Consistency in intent among the target audience — which may be specific to the given genre — tied with a strong awareness among the same group is the clearest path to sequel success. Mission Impossible: The Final Reckoning, the retooled follow-up to Mission Impossible: Dead Reckoning, still retained around 60% theatrical intent among all men. Additionally, awareness grew 14% among this group. The result was a $10 million increase in opening weekend ticket sales for a franchise-high opening. Sonic the Hedgehog 3, following the already successful sequel, merely kept the same level of awareness among audiences under-35 (a still high 76%). Despite this, it significantly grew theatrical intent 9% from the same group. Although Sonic 3, similar to Five Nights at Freddy’s 2, opened smaller than its predecessor, its $60 million debut was still a victory. More importantly, the film proved to have staying power as it earned nearly $50 million more domestically compared to the second film.

Now that we’ve identified the key tells for sequel performance, it’s time we circle back to this weekend’s big release.

28 Years Later: The Bone Temple, similar to the previously referenced films, showed decreases in intent from the target under-35 male demo leading up to release. However, unlike the others The Bone Temple did not enjoy an awareness bump with the same target audience to soften the blow. Rather than attempt to compensate for sinking intent with pumped up awareness, The Bone Temple narrows in on the core horror audience most likely to buy a ticket. As an established IP, The Bone Temple benefits from audience expectations that are sure to push this sequel beyond original horror Primate’s moderate opening last week. But additional pushes in awareness and turnout will be the key for this follow-up’s opening.

Looks like sequels, like boots, can also keep moving up and down again (there’s no discharge in the war!).