Early Movers: Can ‘The Super Mario Galaxy Movie’ Grow Beyond Its Breakout?

February 4, 2026

Early Movers is a new monthly Greenlight Analytics series designed to surface which upcoming films are breaking through early and how they’re doing it. Each installment examines both full-funnel standouts and month-over-month momentum, offering a clearer view of early theatrical demand while there’s still time to act.

When it comes to highly-hyped sequels, the film industry adheres to the immortal words of Britney Spears: “Gimmie, gimmie more.” Many follow-ups earn less than their predecessors (sorry, 28 Years Later: The Bone Temple). But elite franchises grow their audiences from title to title, building both theatrical urgency and enduring downstream value. More, more, more.

That’s what makes the upcoming The Super Mario Galaxy Movie such a fascinating salvo in the ongoing heavyweight battle between Disney and Universal for kids entertainment supremacy. Universal has delivered a flurry of successes culminating in the nearly $1.4 billion global total of 2023’s The Super Mario Bros. Movie. Two months from release, can Galaxy out-perform the original and wrest momentum away from Disney?

How the sequel is tracking vs. the original

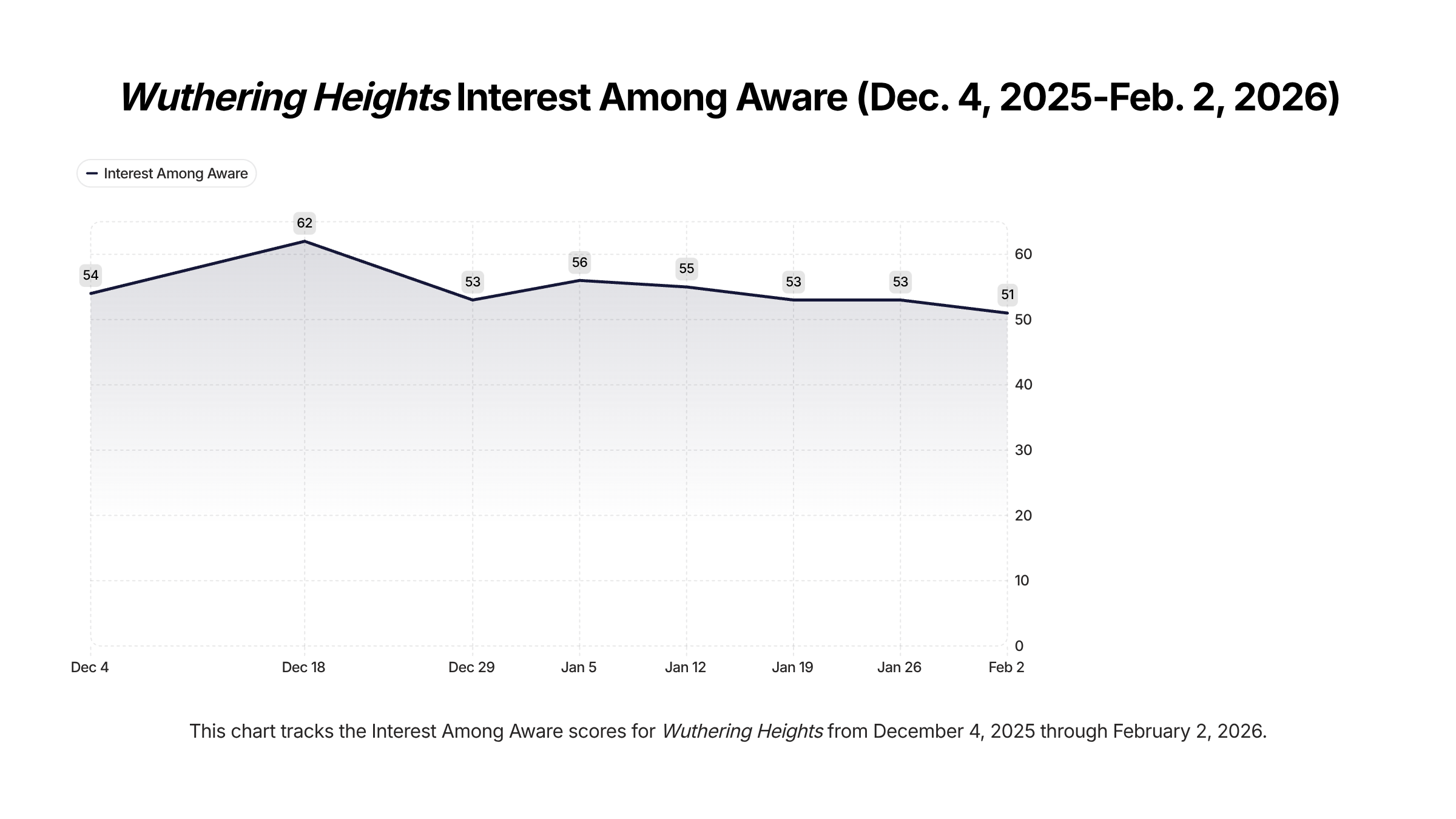

At the same pre-release point, Galaxy is resembling the majority of sequels to breakout originals. Its Awareness is ~12% higher than the original, but it’s lagging behind in Interest (-3%), Theatrical Intent (-9%), and Willingness to Pay a Fee (-15%). Does this mean Galaxy is destined to flop? Absolutely not. It’s tracking very well overall. But it does mean there is work to be done if Universal wants the film to be a long-term grower rather than a front-loaded hit.

![]()

As of now, the sequel is reaching more people earlier than the original thanks to established brand familiarity. The Super Mario Bros. Movie was a smash hit in theaters and was re-watched endlessly on streaming. But while Galaxy is curating a far more evenly distributed Awareness profile across over- and under-35 audiences, that reach isn’t yet translating to equally robust Interest or Intent. This isn’t uncommon. As seen with recent large-scale sequels such as Wicked: For Good and Avatar: Fire and Ash, awareness can shoot through the roof while follow-through doesn’t necessarily keep pace.

The target audience appears to be locked in for Galaxy. Interest Among Aware audiences is 4% higher than the original and Interest among under-35 viewers is materially higher than among over-35 audiences. However, the delta between Theatrical Intent among both films suggests audiences don’t yet view the sequel as urgently must-see as the first movie. In other words, the perceived event value is lower right now. Still, there’s plenty of time to change that. Marketing continues to showcase first appearances for beloved characters such as Yoshi and added-value elements from the broader Nintendo universe.

Working in the sequel’s favor is its more balanced audience profile. The first film’s Theatrical Intent scores over-indexed on 35+ and male viewers. Galaxy is skewing far younger and more evenly gendered, implying even more of a family focus and less of a pure video game-driven nostalgia play. We also can’t ignore that Galaxy’s tracking scores are all moving in the right direction over the last six weeks.

It’s still too early to provide any accurate box office prognosis for Galaxy. But circling back to similar sequels: Wicked 2 opened higher than the original at the domestic box office but earned less overall, while Avatar 3 opened smaller and proved to be less leggy. Can Galaxy pull a Britney Spears and get more at the box office, putting Disney back on the defensive? Only time will tell.

Monthly Momentum

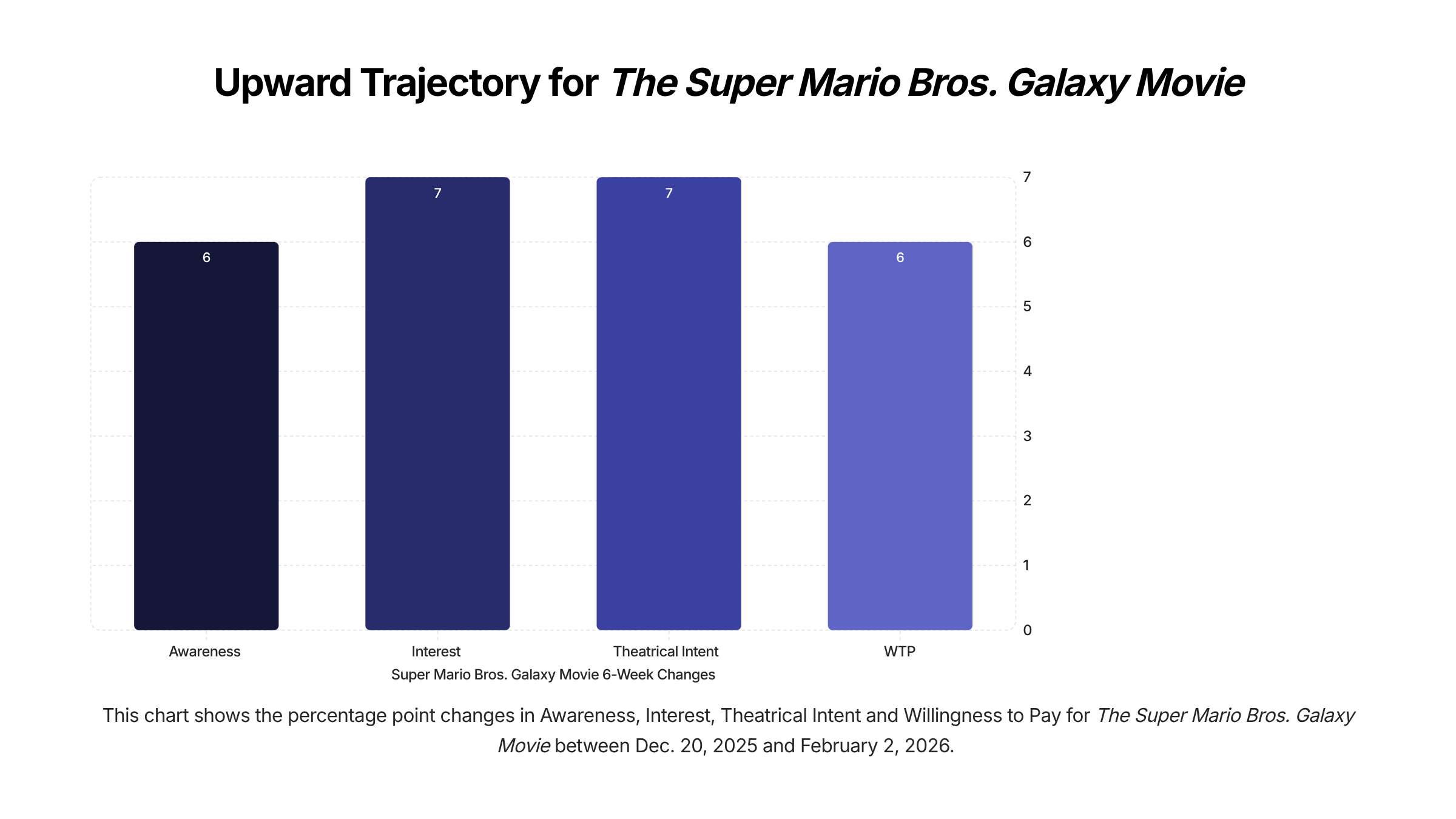

We’ll close each installment with a quick look at month-over-month movement in one key metric for a major film on the horizon. Wuthering Heights has all the ingredients to become a hit, but its Interest Among Aware is headed in the wrong direction.