Early Movers: 4 Films Winning Every Early Signal in 2026

January 6, 2026

The domestic box office totaled roughly $8.6 billion in 2025—on par with 2024 and still 20–25% smaller than the boom years of the late 2010s. Hollywood’s common post-pandemic refrain of “Survive till 2025” has now become “Fix it in 2026.” That’s where we come in.

Theatrical cinema is at a crossroads, especially with Warner Bros. soon to be swallowed up. To aid the recovery, studios and exhibitors need more reliable early performance indicators months before release—data that can inform smarter strategic decisions while there’s still time to meaningfully affect the bottom line.

Early Movers is a new monthly Greenlight Analytics series designed to surface which upcoming films are breaking through early and how they’re doing it. Each installment examines both full-funnel standouts and month-over-month momentum, offering a clearer view of early theatrical demand while there’s still time to act.

Four Films Leading the Way

Out of 48 upcoming films, only four titles currently rank top five across Awareness, Interest, Theatrical Intent, and Willingness to Pay: Scream 7 (February 27), The Super Mario Galaxy Movie (April 3), Michael (April 24), and Toy Story 5 (June 19).

The broad strength each title shows across the entire demand funnel signals meaningful upside at release. Digging deeper, these early indicators also reveal useful insights about box office potential, demographic reach, and genre affinity.

Why Full-Funnel Alignment Is So Rare

When a film arrives in theaters and is met with a collective shrug of indifference, the hit to the P&L isn’t usually driven by a single weak metric. It’s not just low awareness or soft intent. More often—especially with highly hyped franchise IP—underperformance stems from a fatal imbalance. Sky-high awareness that fails to convert into theatrical intent, or broad interest that never develops urgency.

Ranking top five across all four metrics implies something rarer: wide awareness and curiosity, theatrical intent and long-tail monetization potential. That balance is often the clearest early signal of a successful release.

Shared Traits Among the Core Four

All four titles over-index with under-35 audiences even when the age of the IP might suggest otherwise. The Scream and Toy Story franchises are now in their early 30s, Super Mario debuted in 1985, and it’s been a quarter-century since Michael Jackson released his final studio album. (Michael does already show notable strength among women 35+.) Still, younger audiences are expressing a clear desire to see these films in theaters, effectively eventizing their releases.

Our Willingness to Pay metric captures respondents’ intent to buy a theatrical ticket, make a VOD transaction, or subscribe to a streamer to watch. Essentially, it’s a reflection of monetization potential across windows. High scores here, paired with strong theatrical intent, suggest multiple revenue paths.

Why does this matter? Because each of these films blends franchise equity, genre reliability, and cultural reframing. Family-friendly animation remains the most consistently high-ceiling blockbuster category, particularly for sequels to beloved brands. Horror is a steady ROI driver. Musical biopics routinely punch above their weight and Michael Jackson remains the most famous artist of the 20th century. By contrast, recent IP-driven disappointments like Joker: Folie à Deux and Snow White were defined by massive awareness that failed to translate into audience action.

If there’s one vulnerability studios should focus on, it’s older moviegoers. Averaging Theatrical Intent by age cohort shows under-35 audiences holding roughly a 10-point lead over the 35+ demo. To paraphrase Thanos: balance, in all things.

Final Word

Across 48 upcoming films, sustained early demand that tracks consistently across visibility, intent, and monetization is rare. These four titles offer a clear snapshot of what early theatrical health looks like heading into 2026. Understanding a film’s strengths and weaknesses weeks or months in advance serves two critical purposes:

- it allows studios to meaningfully improve outcomes through more precise promotion, and

- it helps exhibitors better forecast and plan around audience demand.

Monthly Momentum

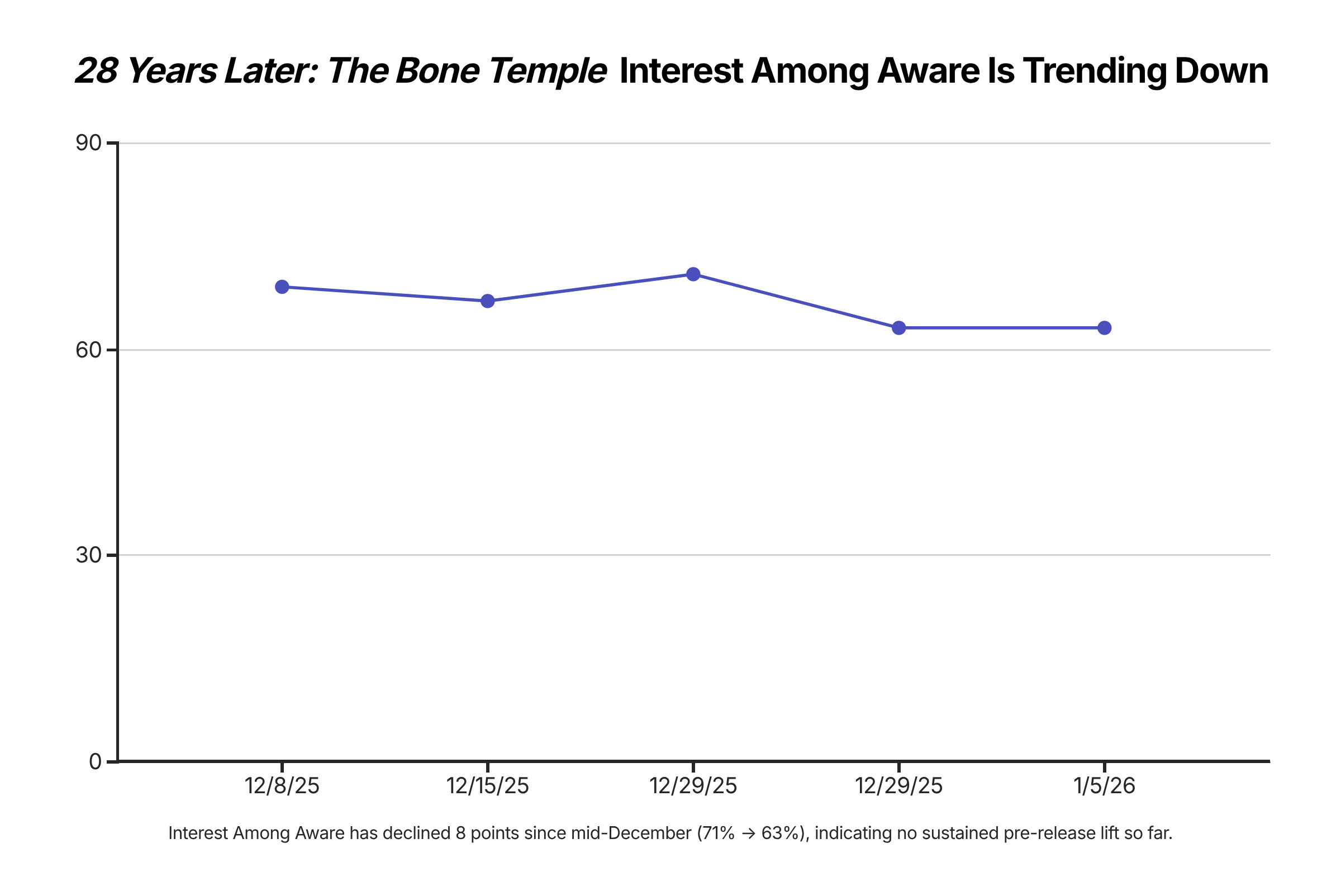

We’ll close each installment with a quick look at month-over-month movement in one key metric for a major film on the horizon. For January, that film is 28 Years Later: The Bone Temple. Its predecessor grossed just north of $150 million worldwide on a $60 million budget, with Interest Among Aware audiences jumping from 75% one month before release to 93% at opening. Unfortunately, the critically acclaimed sequel isn’t following that same trajectory (at least not yet).