Box Office Behavior: Hollywood’s Vanishing Middle Class

November 26, 2025

In 2024, the five major theatrical movie studios — Disney, Universal, Warner Bros., Sony, Paramount — delivered 62 wide releases to cinemas. Just 20 of these films cost less than $100 million to produce. It’s a trend that’s remained relatively consistent in Hollywood’s current recycled blockbuster era. Mid-budget fare, once the lifeblood of theatrical cinema throughout the 20th century, has seemingly gone the way of low-rise jeans, baggy parachute pants and jelly sandals (sorry, Millennials). But the reality is more nuanced than that.

Overall Hollywood health is reliant on a somewhat successful middle class in the $20 million-$90 million budget range. Blockbusters that cost nine-figures can deliver massive slate-propping success or C-Suite erasing failures. Micro-budget films are steady, low-risk ROI drivers, but rarely reach the $400 million floor of needle-moving tentpole success. Studio executives used to be defined by the ability to program moderately budgeted hits like Rain Man, Toy Story, and Meet the Fockers that buttressed bottom lines. Now execs are largely judged by the performance of one or two “event” films.

Despite the middle-class squeeze, mid-budget movies can and do still succeed, albeit in separate ecosystems. Hollywood is struggling far more with a marketing problem than an audience issue. As the New York Times recently argued, studios are adept at flooding traditional channels with loud, expensive shotgun-blast marketing. But advertising—which is designed to elicit a decision from the consumer—is driven by segmenting, sequencing, and message alignment. And that’s exactly where mid-budget titles either out-perform expectations or get KOed on opening weekends.

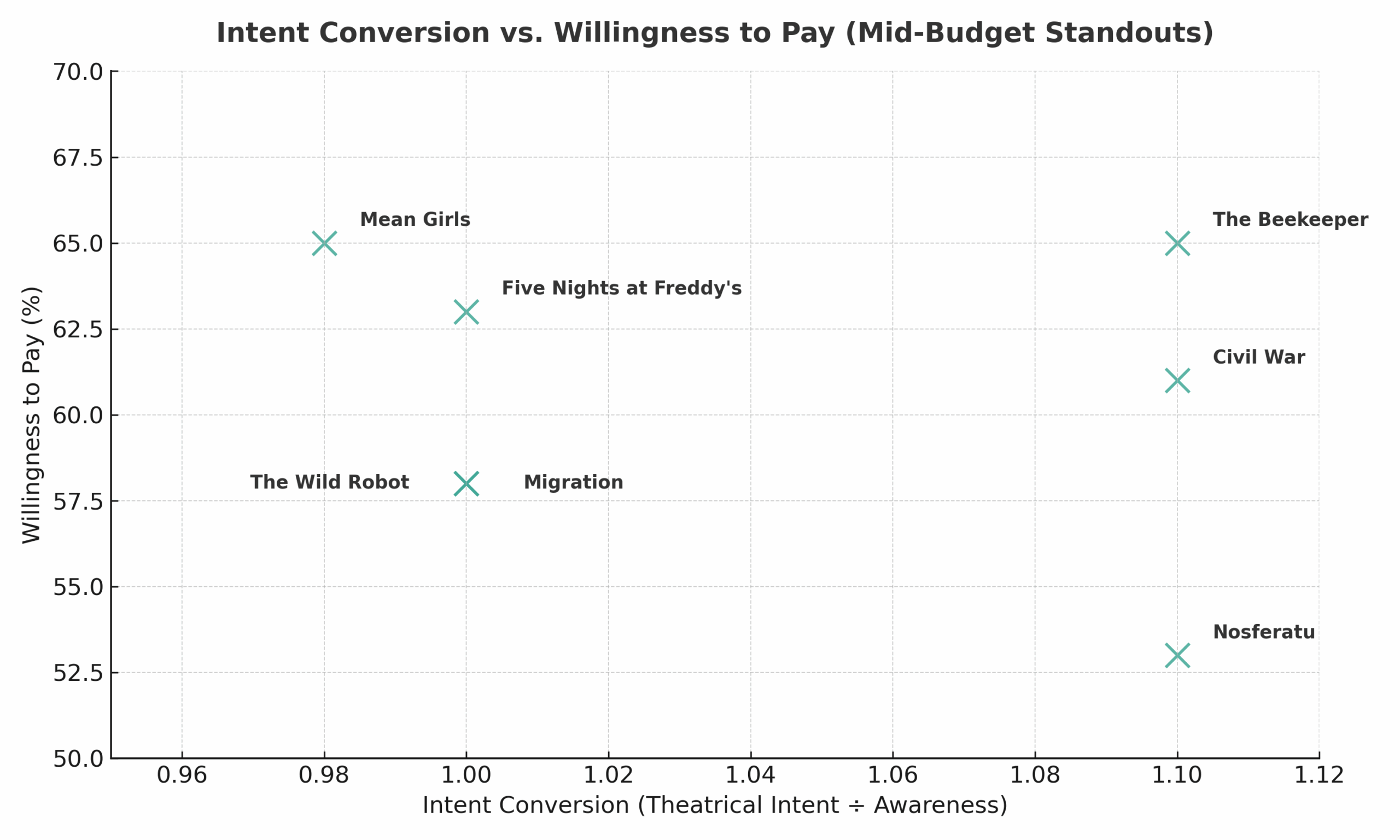

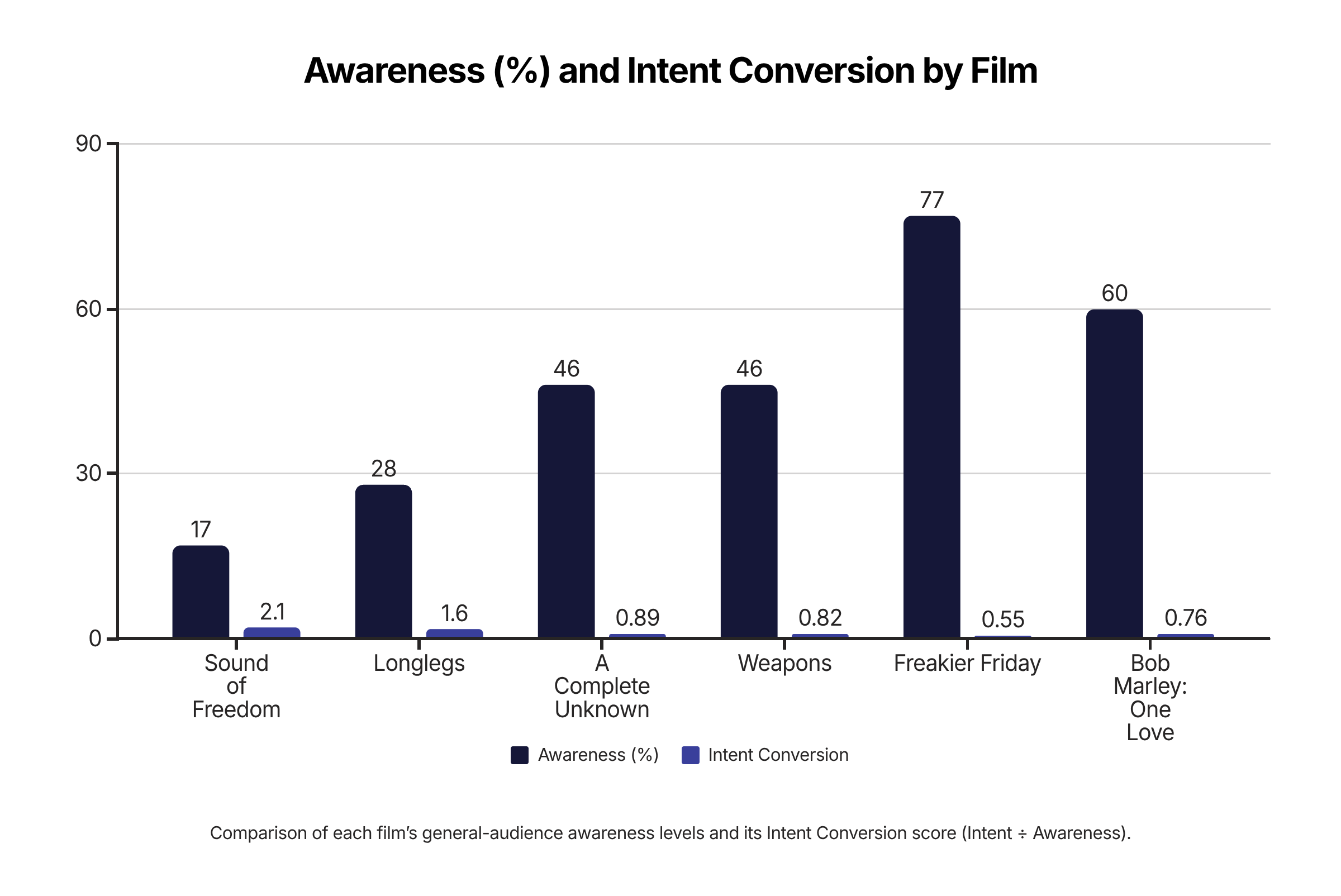

Theatrically, success in this lane comes down to how efficiently awareness converts into audience turnout (Intent Conversion). On major streaming platforms such as Netflix, the goal is to generate a healthy ratio of engagement hours per dollar spent (Reach Efficiency). Analyzing both allows us to better understand the tightrope walk to success in this shrinking space. So that’s what we’ve done.

For this study, we explored two key facets:

- Intent Conversion (theatrical intent divided by awareness in the week of release), Willingness to Pay (the share of respondents who say they would buy a theatrical ticket, make a PVOD/TVOD transaction, or subscribe to a streaming service to watch a given film) and domestic box office for 30 theatrical films released from 2023-2025 that earned at least $65 million domestic on sub-$100 million budgets.

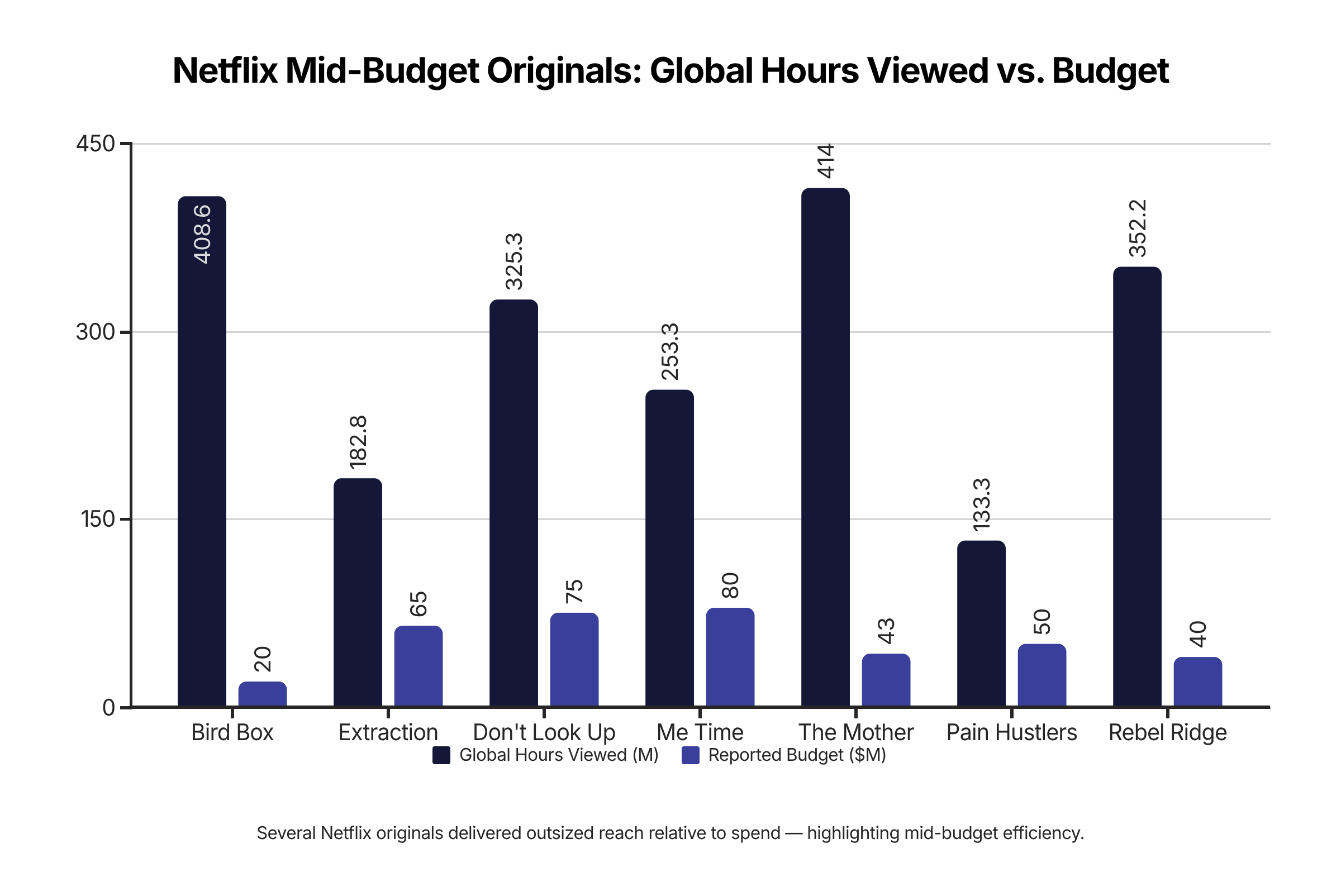

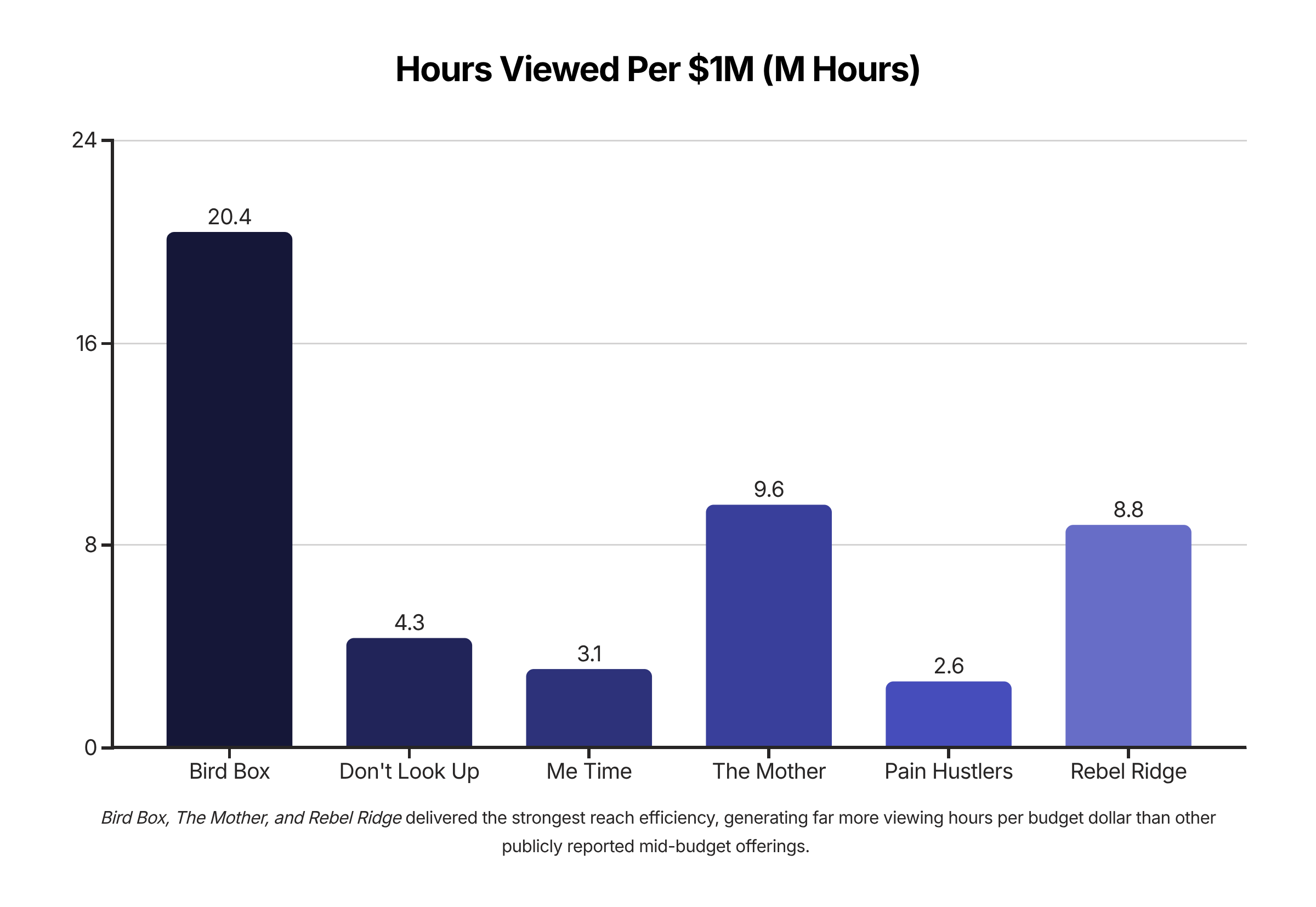

- Global hours viewed for reported Netflix original mid-budget films to derive Hours Viewed per $1 million spent

Finding the Theatrical Sweet Spot

The only group of people that may be more fickle than sports fans are moviegoers. Believe me, if we had a crystal ball that could accurately predict their behavior, I’d be furiously updating my Instagram with exclusive beach content instead of writing this essay right now. But by measuring Intent Conversion, we can glean a few critical insights.

The goal with this metric is to earn a ratio close to 1.0, which reflects a strong alignment between a film’s marketing and an audience’s appetite. An Intent Conversion score above 1.0 can indicate a dearth of marketing; audiences were intrigued by the concept, but haven’t necessarily been reached/activated enough to buy a ticket. A score below 1.0 (usually around 0.7) often implies over-exposure and ineffective marketing that didn’t align conceptually with audience tastes. Of course, there are exceptions. Familiar brand-name IP (Wicked, Superman, etc) skew lower because of organically inflated awareness. But generally speaking, this is a good measure of activation.

Again, the difference between marketing and actual advertising is apparent here. Low Intent Conversion scores aren’t evidence of a shrinking audience. Instead, they signal a misalignment with audience tastes (such as movie fans who will never see superhero or horror films despite the awareness), or the campaign failed to transition from broad awareness to targeted activations (and sometimes both!).

Titles with WTP scores above 50%—which is a direct measure of transactional intent, not just interest—generally earn Intent Conversion scores closer to 1.0. The takeaway here is that appeal, marketing and a willingness to spend money are all unsurprisingly connected. There’s a clear monetary follow-through when these two metrics are aligned.

That alignment validates both marketing and the audience’s perceived quality, with success often concentrated in a few key areas. Family friendly animation (The Wild Robot, Migration, The Garfield Movie) and horror (Five Nights at Freddy’s, Nosferatu, Alien: Romulus, A Quiet Place: Day One) tend to be the most consistent performers under this lens, with action/thrillers (The Beekeeper, Civil War, Creed III) and music-driven movies (Mean Girls, A Complete Unknown, Taylor Swift: The Eras Tour) also chipping in. The throughline is that these promotional campaigns don’t over-emphasize awareness and interest at the cost of eliciting a paid transaction. Instead, these campaigns are driving awareness early before transitioning to conversion campaigns with the bulk of their spend in the final weeks leading up to release. They’re giving audiences a reason to come to theaters once they know about the movie.

The Reward of Netflix’s Reach

Netflix appointed Dan Lin as Chairman of Netflix Film in April 2024. Under Lin, the streamer is aiming for 25-30 English language original movies per year. “Most of those will be original ideas and cost less than $100 million,” according to The Hollywood Reporter. The voluminous free-spending streamer has been angling for slate optimization, a trendy Hollywood buzzword that roughly translates to “we need more bang for our buck!” Fortunately, that’s an easier lift for the company than for a theatrical studio because its home page is its central marketing tool. A constantly updating personalized recommendation engine as opposed to an awareness microphone.

As the default streamer, Netflix is already well saturated in the U.S., making its engagement hours a proxy for our usual Willingness to Pay metric. This can help us better understand the ROI for certain films as dividing hours viewed by publicly reported budgets should ideally result in a higher number. (Note: Due to Netflix’s evolving viewership disclosures, we do not have a public record for lifetime engagement for films released before 2023. However, outside of Extraction, these totals, compiled from the streamer’s self-reported Top 10 lists and bi-annual engagement reports, account for the majority of viewership per title).

By virtue of its volume, Netflix delivers a not insignificant number of original films that largely go unnoticed. But successful mid-budget fare tends to boast a decent floor of 130 million global viewership hours and a ceiling much higher than that. You’ll notice these mid-budget successes often fall into specific genre taste clusters such as action, sci-fi, and thriller (sometimes a blend of all three in one title!). The combination of Netflix’s global reach and audience alignment can result in impressive viewing efficiency for the right title that catches fire (Film Twitter still fondly remembers the Bird Box memes).

Netflix’s streaming model isn’t reliant on converting awareness into intent in the same way that the theatrical industry hopes to eventize major releases (though, for what it’s worth, 40% of respondents said they’d be willing to pay for Netflix’s upcoming Wake Up Dead Man: A Knives Out Mystery). Instead, the streamer’s home page is the most valuable real estate in the entertainment industry that feeds its subscription model by generating extended engagement.

Strategic Implications

Eventization and ease of access, aligned with real-time consumer tastes, drive mid-budget success across these mediums. While this tier faces increasing industry challenges, successful examples tend to be concentrated among horror, music, family animation, action, sci-fi and thrillers. Specialty films like The Eras Tour and fandom-driven genres like the anime Demon Slayer: Infinity Castle or the BookTok embraced romance It Ends With Us can pop at the box office on affordable budgets as well. Their novelty plays into their appeal and provides additional marketing hooks.

For studios and theatrical marketers, the key is not to overshoot awareness. This is the central crux of the “advertising over marketing” pivot that Hollywood is struggling to embrace. Awareness is still crucial, but relying on awareness alone is as outdated as hand-cranked cameras. Precise audience segmentation, tailored frequency and tiered campaigns are what helps awareness-driven curiosity eventually evolve into actual revenue.

Remember, an Intent Conversion score near 1.0 indicates a calibrated rollout that organically bridges awareness and intent. Different ratios between Awareness and Intent Conversion can yield both outliers and as-expected results based on how well you mobilize your audience. Tracking WTP alongside this can help differentiate between mild audience curiosity and monetizable interest to better direct your promotional dollars. For streamers, mid-budget fare can continue helping to fill library holes at reasonable cost. The goal shouldn’t necessarily be mega-hits, but efficient ROI focused on hours per dollar spent. Extended engagement and rewatchability represents the real value to streamers and a boost to digital libraries.

Following these tracks can help ensure that the mid-budget movie never goes fully extinct in Hollywood.